EU Inc: The Silent Game-Changer for Europe’s Mid-Market Powerhouses

The buzz around "EU Inc"—Europe’s bold move toward a unified company status—has been predictably dominated by the startup narrative. Pundits and policymakers laud its potential to unleash a wave of unicorns, freeing nascent ventures from the labyrinthine legalities of cross-border expansion. But focusing solely on the early-stage trailblazers misses a crucial point: EU Inc isn't just a breakthrough for startups; it’s a quiet revolution for Europe’s established, yet often overlooked, medium-sized enterprises and small mid-caps.

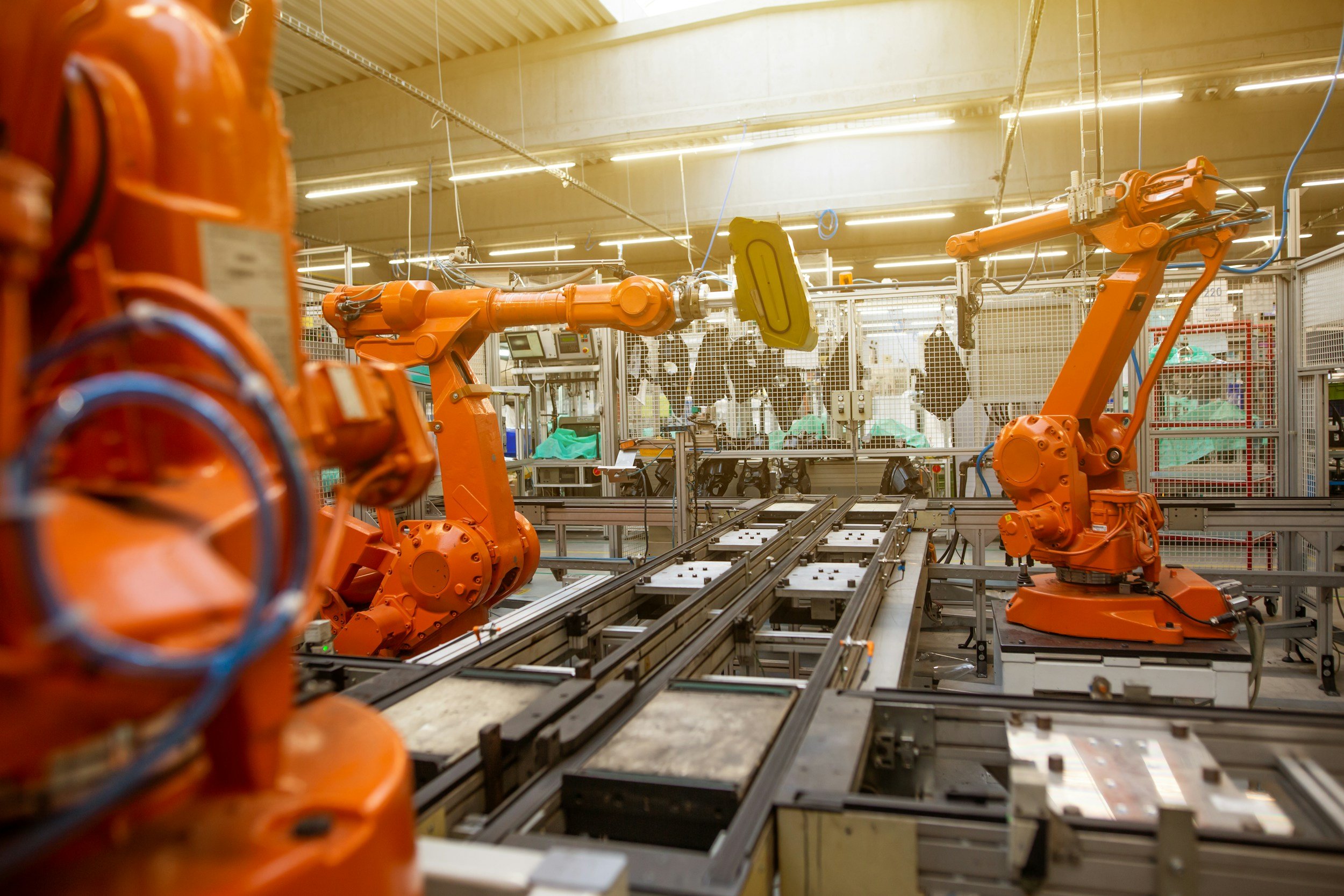

These are the backbone companies: the regional manufacturing specialists, the niche tech developers, and the innovative service providers who employ millions. They are past the "ramen-and-seed-funding" stage, but they often hit an invisible wall when scaling beyond national borders. This isn't a failure of ambition; it’s a failure of fragmented bureaucracy.

Imagine a successful German Mittelstand company wanting to open a factory in France or acquire a competitor in Italy. Today, they face a bewildering array of national corporate laws and administrative hurdles. Each expansion demands new legal entities, fresh compliance checks, and a significant drain on resources. It’s like running a marathon where every mile marker requires you to change your shoes and learn a new language.

The "Unified European Company" (S.EU) status—the heart of EU Inc—is a genuine game-changer for these mid-market powerhouses for three reasons:

Unshackling Expansion: With S.EU status, a company can operate across the entire bloc under a single legal framework. This isn't just about saving legal fees; it’s about agility. It empowers a Dutch engineering firm to bid on a Polish project or a Spanish producer to hub in Sweden without being bogged down in 27 different rulebooks.

Democratizing Capital: Mid-sized companies often fall into a "scale-up gap"—too large for early venture capital, yet too "legally complex" for global institutional investors wary of European fragmentation. Standardized investment instruments make these firms legible and attractive to global capital.

The Talent War: Currently, offering equity to employees across different EU countries is a Byzantine nightmare of conflicting tax laws. EU-ESOP (the harmonized stock option framework) allows a Portuguese firm to offer its German engineers the same ownership incentives as its local team, fostering a truly pan-European talent pool.

The Road to Reality: 2026 and Beyond

We are no longer talking about a distant "what if." Following Ursula von der Leyen’s official endorsement at Davos on January 20, 2026, the legislative clock is ticking fast.

The Proposal (March 2026): The European Commission is set to unveil the formal legislative draft by the end of next month.

The Debate (Late 2026): Negotiations will intensify over whether this becomes a Regulation (immediate, identical rules across the EU) or a Directive (which gives member states more flexibility but risks some fragmentation)

The First S.EU (2027): If the momentum holds, the first companies could be incorporating under the EU Inc banner by early 2027.

For the mid-cap CEO, the message is clear: the "28th regime" is coming. It won't replace your national identity, but it will finally give you a European passport for your business. Let the startups grab the headlines; the mid-caps will be the ones using this tool to build the next generation of European giants.

Subscribe to insights

for leaders, innovators & investors.

Links to dig deeper

01

Tech.eu: The European Commission Launches EU Inc.

This article covers the major January 20, 2026, announcement at Davos where President Ursula von der Leyen officially endorsed the framework. It outlines the core features like 48-hour digital registration and the standardized ESOP framework.

02

The Recursive: EU Inc is Confirmed - What That Means

A deep dive into the legislative timeline (Q1 2026 proposal, 2027/2028 reality) and why this is a strategic shift for Europe’s competitiveness. It specifically highlights the goal of making cross-border financing and expansion as easy as it is in the US or China.

03

European Parliament News: MEPs Propose New Legal Framework for EU Competitiveness

The official press release from the European Parliament regarding the January 2026 vote on the recommendations for the S.EU (Unified European Company). This is the best source for technical details on the "28th Regime" and the S.EU status.